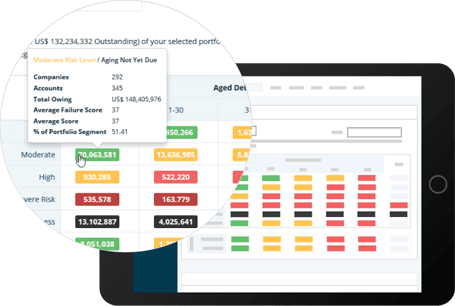

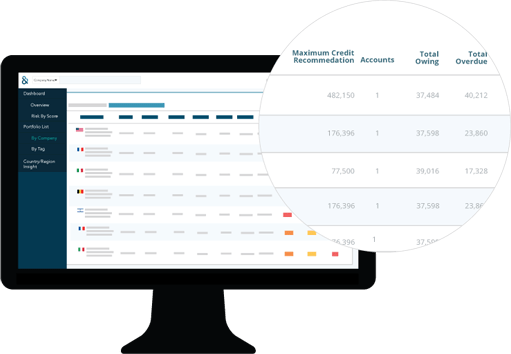

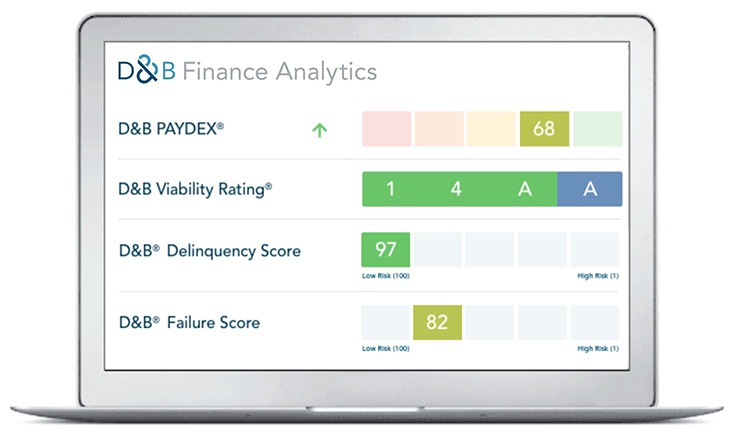

The next generation risk intelligence platform delivers Dun&Bradstreet’s industry-leading data and analytics for smarter, faster decisions

D&B Finance Analytics provides AI-driven solutions powered by the Dun & Bradstreet Data Cloud. Intelligent, flexible, and easy to use, D&B Finance Analytics helps finance teams to manage risk, increase operational efficiency, reduce cost, and improve the customer experience.